For such guidance, please consult a qualified tax and/or legal advisor. * Neither UFCU nor CUSO Financial Services, L.P. You should receive this document in the mail, or you may have been given this document when you opened your UFCU account. Members who need this form can complete it with the help of a UFCU representative when opening a UFCU account. Any Members who are foreign to the US and do not have a social security number must complete this form. This form is used to record foreign taxpayer identification information for Members who are the beneficiaries of interest earnings reported to the IRS.

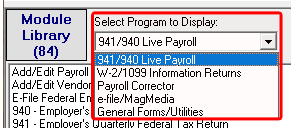

Cfs tax tools software#

You should receive this document in the mail.Ĭertificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals) is a leading developer of tax utility software for tax professionals. TaxTools, our flagship product, is the best-selling program of its kind.

Each year, over 30,000 tax and accounting firms across the United States trust CFS for affordable, high-quality, and reliable software. This form is triggered when UFCU has been informed by the IRS that a social security number is missing or does not match their records. is a leading developer of tax utility software for tax professionals. Request for Taxpayer Identification Number and Certification You will receive this form even if you had no contribution activity for the year. BotW is also a great place for designers to showcase their work.

Cfs tax tools download#

This form reports all contributions to UFCU IRAs and/or the fair market value. Brands of the World is the world's largest library of brand logos in vector format available to download for free. To determine whether you should receive a 1099-R, find your distribution total on the bottom of your December statement. Any distribution from a UFCU IRA triggers this form. You’ll talk to real people who can help you with your questions about our software. This form reports any distributions from a UFCU IRA.

To determine whether you should receive a 1099-INT, find your year-to-date interest earned on the bottom of your December statement.ĭistributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs This form is only generated on accounts that have earned $10 or more in interest for the year. You may also request this form at any UFCU location, or log in to Online Banking, and choose My Accounts » Statements & Documents, and then select Tax Statements. You should receive this document in the mail. Any interest assessed on a mortgage loans triggers this form. It seems like someone was trying to steal my information and Google Chrome stopped it. But before it was going elsewhere 'TAXTOOLS'.

We'll help you pick the best software for filing, and guide you toward helpful books and other educational materials. Try google cfs tax software should take you right there. As a result, they can prepare the proper tax return forms and perform accurate tax calculations.This form reports interest paid on your UFCU Mortgage loan. Still using a pen and paper to file your taxes You're behind the times. For instance, the software gives them questions that they can answer so they can immediately determine the tax or filing status of their clients.

Cfs tax tools pdf#

They can deliver these tax returns to their clients as PDF documents via email.Īchieve Compliance with Changing Tax Laws and RegulationsĬFS TaxTools assists users in ensuring that their clients are able to comply with tax laws and regulations that can change anytime. The tax management software makes it possible for accounting agencies and professionals to prepare and accomplish tax returns that look very neat and professional.

Cfs tax tools professional#

Produce Tax Return Forms that Look Neat and Professional This way, they will be able to serve their clients better who are relying on them. Discover how CFS TaxTools can help you serve your clients better through the following discussion:ĬFS TaxTools gives users a system where they can perform the tax calculations and access all the worksheets they need at an affordable price. The main benefits of CFS TaxTools are it permits accounting agencies and professionals to leverage its capabilities without the need to spend a lot of money, produces tax return forms that look neat and professional, and helps users ensure that their clients are able to comply with changing tax laws and regulations.

0 kommentar(er)

0 kommentar(er)